Taking Back the Market | Equipping Glaziers to Compete in Division 10 | Part 1

Specifications

Read Part 2 of Taking Back the Market | The Product

Read Part 3 of Taking Back the Market | The Sales Process

Sometimes the competitive temperature in the glass market seems to rise suddenly. The bad news is that it’s not all that sudden. The market has been moving for years. The good news is that you can move with it. Glaziers are well-positioned to leverage existing expertise and relationships to compete in a new way, but you must know how.

Over the last decade, glaziers have been gradually eliminated from interior glass installations because work that was traditionally specified as Division 8 and is now being specified through Division 10.This change has tended to benefit furniture dealers over glaziers.

The first article of this three-part series will dive into how the Master Specification defines Divisions 8 and 10, and why that difference influences the products that building owners and architects specify.

Why glass is such a hot commodity

For the first time in 20 years, architectural billings for renovation and refurbishment have overtaken new construction. A lot of the office space in this country can be found in huge, multistory buildings. These older buildings need a facelift to attract tenants. As a result, building owners are retrofitting their interiors with glass.

Glass is a cost-effective way to upgrade or refresh a property image.

- Glass visually supports collaborative work, flexible work schedules or co-working, where individuals and groups work at an office together even though they work on different projects or for different employers.

- Glass helps maximize and open up space in small rooms, thus allowing for a smaller office footprint.

- Glass supports daylight harvesting—maximizing use of natural light in a space.

- When properly configured and used, glass can create an appropriate level of acoustical privacy for multiple kinds of spaces, while keeping the space visually open.

The “why” of using architectural glass is easy. Considering “who” is installing the glass is where it starts to get interesting.

How the master spec shapes the industry

Any construction project in the United States coming out of an architecture and design firm utilizes a Master Specification document that adheres to Construction Specification Institute guidelines. The Master Specification contains multiple divisions. Think of this as the “table of contents” for a project.

Electrical contractors will reference their division of the Master Specification when bidding on a project. The same is true for all trades working in construction, including glaziers.

Glass office fronts have three elements: aluminum frames, doors and door hardware, and glass. Here’s the catch: they can be specified as components in Division 8 or as systems in Division 10. “Components” and “systems’ are not just two words for the same thing. They are very different solutions, sold through different channels.

Glaziers need to understand the difference if they want to recapture market share.

Understanding the Difference Between Division 8 and 10: Components vs. Systems

Division 8 is where glaziers have traditionally competed when installing glass for building interiors. Important distinguishing characteristics of this specification include:

- The component parts may or may not come from a single source. The solution is not considered a “system.”

- The components include primarily monolithic glass.

- The aluminum, hardware and glass are typically sold by a glazier and the work is managed through a general contractor.

This is how things worked for many years.

But over the last few decades, office furniture manufacturers have gotten involved. They applied their systems knowledge, leveraged the tax code and created a new entry for the Master Specification called Division 10, which is very different from Division 8

Division 10 glass office fronts are called demountable walls. Division 10 is very different from Division 8. The most important distinction between the two is that Division 10 is sold as a system: either unitized or stick-built. The majority of demountable walls, whether unitized or stick-built, are sold through furniture dealers.

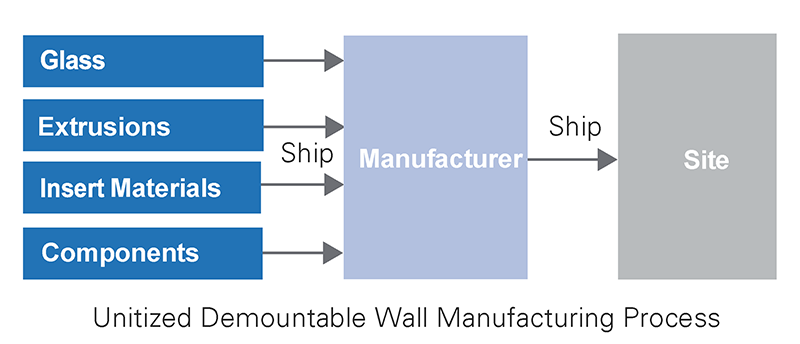

A unitized demountable wall system typically arrives on-site fully or partially assembled. It can be:

- A unitized frame. The product is fabricated at a manufacturer’s facility with frame, glass and other materials assembled into a wall that ships whole.

- A unitized frame and skin. In this application, the frame is fabricated at a manufacturing facility and then the glass and doors are assembled on-site.

Given that it is either fully or partially assembled when it arrives, the unitized demountable wall is the easiest solution to install.

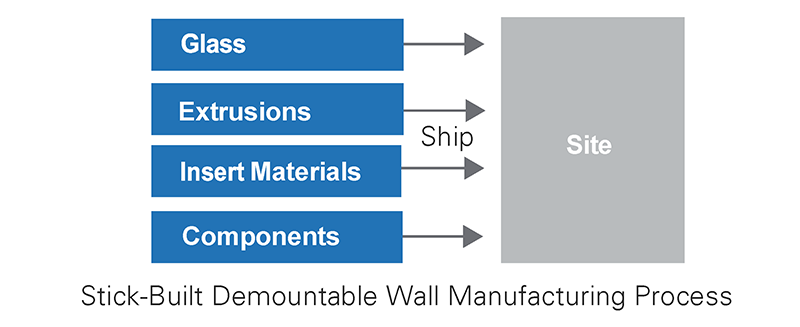

A stick-built demountable wall system arrives unassembled at the site. The aluminum, glass and/ or other insert materials ship to the installation site or distributor separately, from different suppliers. A manufacturer might prefabricate parts of the installation (such as the extrusions) at their facility, a distributor’s location, or at the jobsite; then install the glass at the jobsite.

Tax Rules and Testing Both Affect Specification of Division 8 Components

The distinctions between Division 8 and 10 have real-world consequences in terms of which products are specified and who installs them.

Remember that Division 10 products are classified as “systems” and Division 8 products are not. Systems, including Division 10 products, can be tested for noise transmission (STC rating) and documented as achieving certain levels of soundproofing. Division 8 components are not tested because they are sold as individual pieces.

From the architect’s perspective, this distinction is huge. If acoustic properties matter to the architect or end user, they’re going to specify glass office fronts in Division 10, because they can be chosen based on a documented level of sound reduction.

Additionally, when we move from components (Division 8) to a demountable wall system (Division 10), the tax rules also change. A demountable wall can be moved and used again, so it is considered personal property (like furniture), rather than a part of the building structure. Thus, it can be depreciated over seven years versus 39 years. Although depreciation is a non-cash expense, it does lower an end user’s taxable income.

Here’s an example. Assume that a business was going to spend $100,000 on interior glass walls. This simplified income statement shows that the business would save $2,461 on taxes just by specifying the glass walls through Division 10 rather than Division 8.

Inflation lowers the worth of future dollars compared to today’s dollars, and it is more advantageous to take the depreciation deduction in a shorter period of time. Thus, a demountable wall sold through Division 10 offers more financial benefit to the end user than a Division 8 glass solution.

STC ratings and tax savings are two factors affecting why architects specify, and end users purchase, glass walls through Division 10. Since Division 10 systems are typically sold through office furniture dealers or direct to end users, glaziers are cut out right from the beginning. Ergo, the market has moved.

Stay Tuned for the Rest of the Story

The next article in this series will help you understand more about the “what” of Division 10. You’ll learn more about the companies that are selling in Division 10, along with the features and preferences that are most desirable.

Our final article will showcase the “how.” We’ll explain the timeframe, influencers and sales process in Division 10 so that you know where and how to jump in.